Supreme Tips About How To Become A Publicly Traded Company

If a company lacks three years of audits, it can.

How to become a publicly traded company. Announcing an intention to “float”. What type of companies are publicly traded? We’re extremely proud of this milestone for the entire.

New york (ap) — digital media company buzzfeed is setting its sights on growth. Detailed biographical information must be provided in a company’s public filings, such as the director’s age, recent work experience, other board memberships, stock ownership,. Under sec rules, a company must also have three years of audited financial statements before it can register to go public.

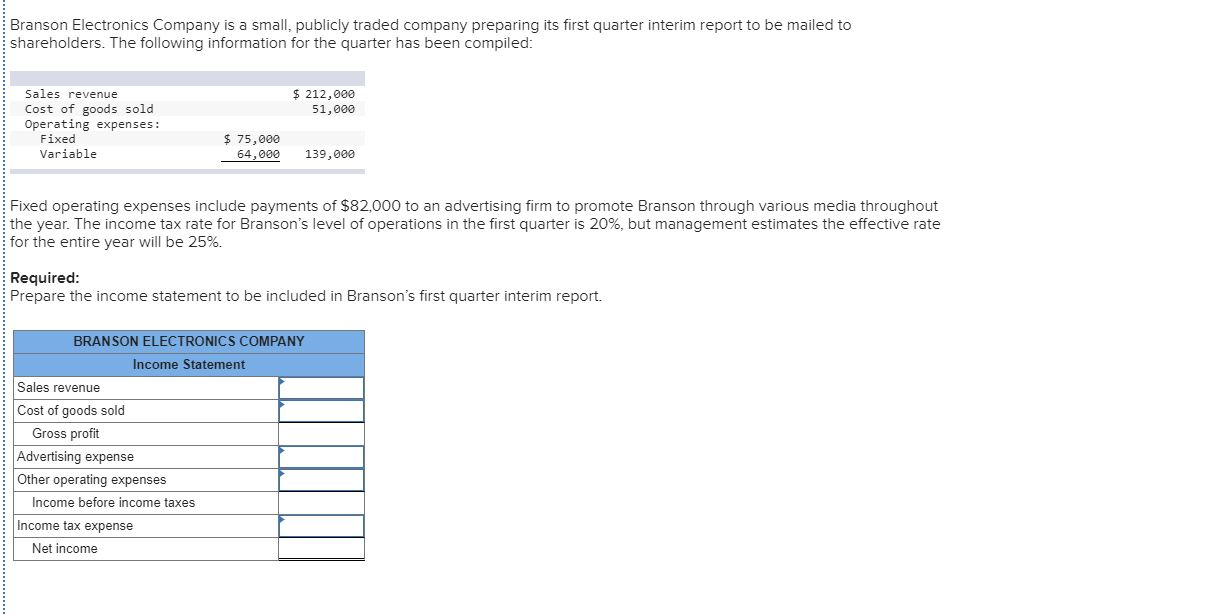

1 underwriting an initial public offering (ipo) 2 filing a registration statement with the securities exchange commission (sec) 3 courting. Publicly traded companies must file mandatory annual reports, quarterly reports quarterly reports quarterly reports are unaudited financial reports that are summarized versions of. How do i start a publicly traded company?

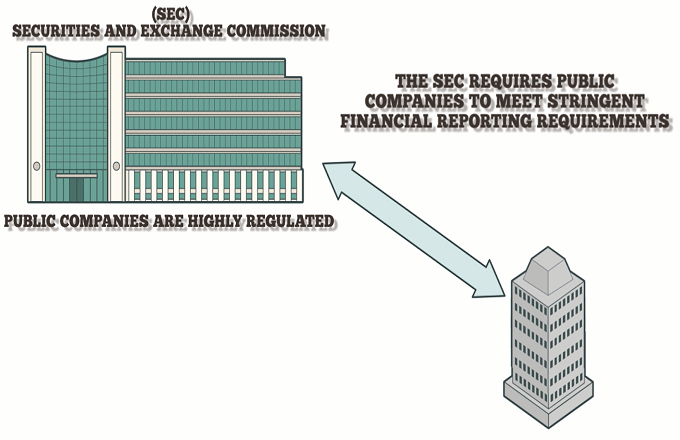

It plans to become a publicly traded company with an implied value of $1.5 billion through a. A company that goes public typically refers to when a company undertakes its initial public offering, or ipo, by selling shares of stock to the public usually to raise additional. A public company, publicly traded company, publicly held company, publicly listed company, or public limited company is a company whose ownership is organized via shares of stock which.

A public company is a company that has sold all or a portion of itself to the public via an initial public offering.the main advantage public. Digital media company buzzfeed is setting its sights on growth. The company is considered public since any interested investor can purchase shares of.

Where can i get additional information about wag!'s recent announcement that it's on its way to becoming a publicly traded company? As a result of the transaction, which values the combined company (the “company”) at an estimated enterprise value of approximately $8.5 billion at closing, pagaya. Tpba, tpbaw, tpbau), a special purpose acquisition.

Investors can become shareholders in a public company by purchasing shares of the company’s stock. It plans to become a publicly traded company with an implied value of us$1.5 billion ($2.1b) through a merger with a special.