Outstanding Tips About How To Build A Dcf Model

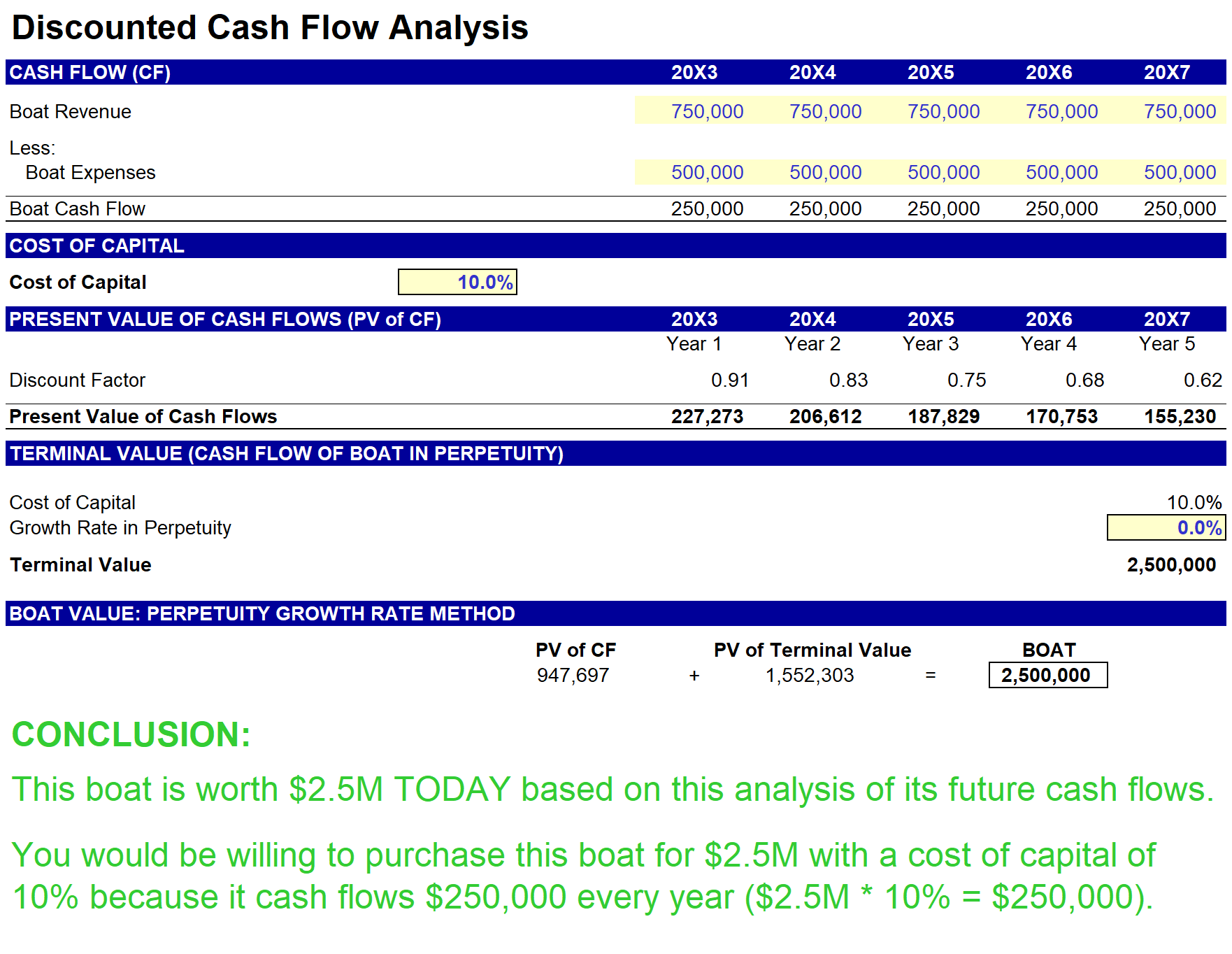

Cf1 = cash flow for year one;

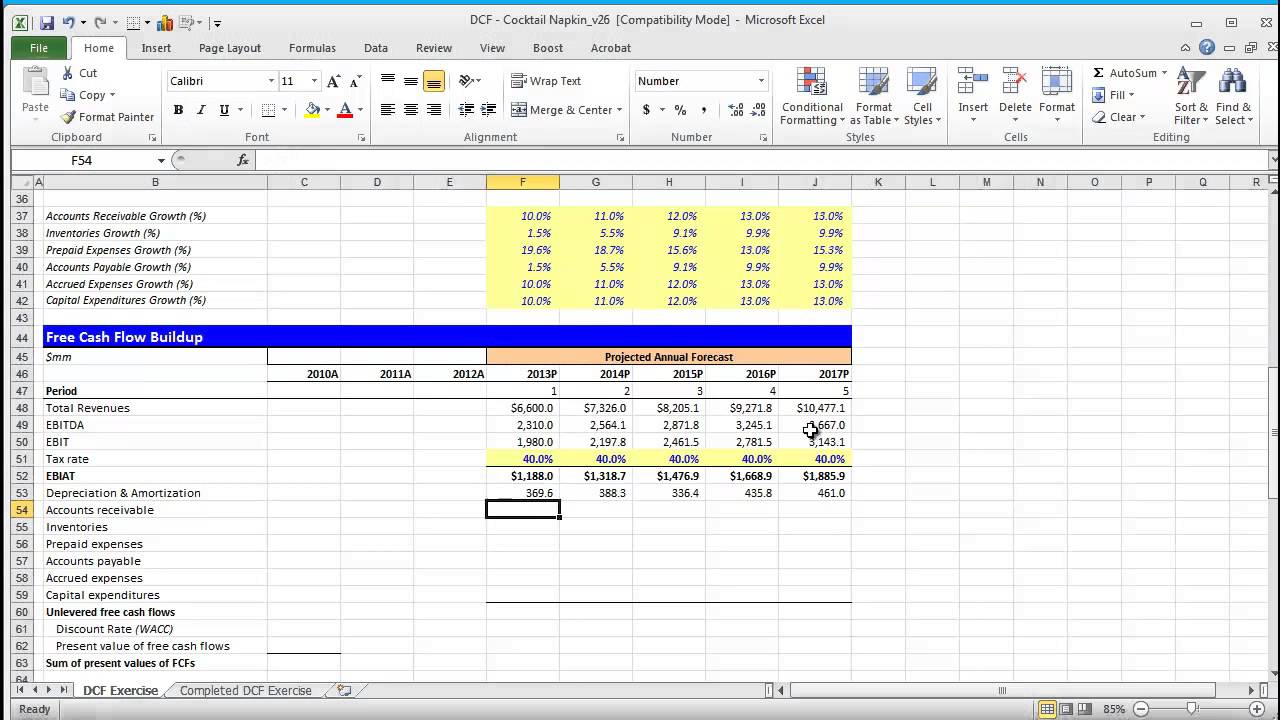

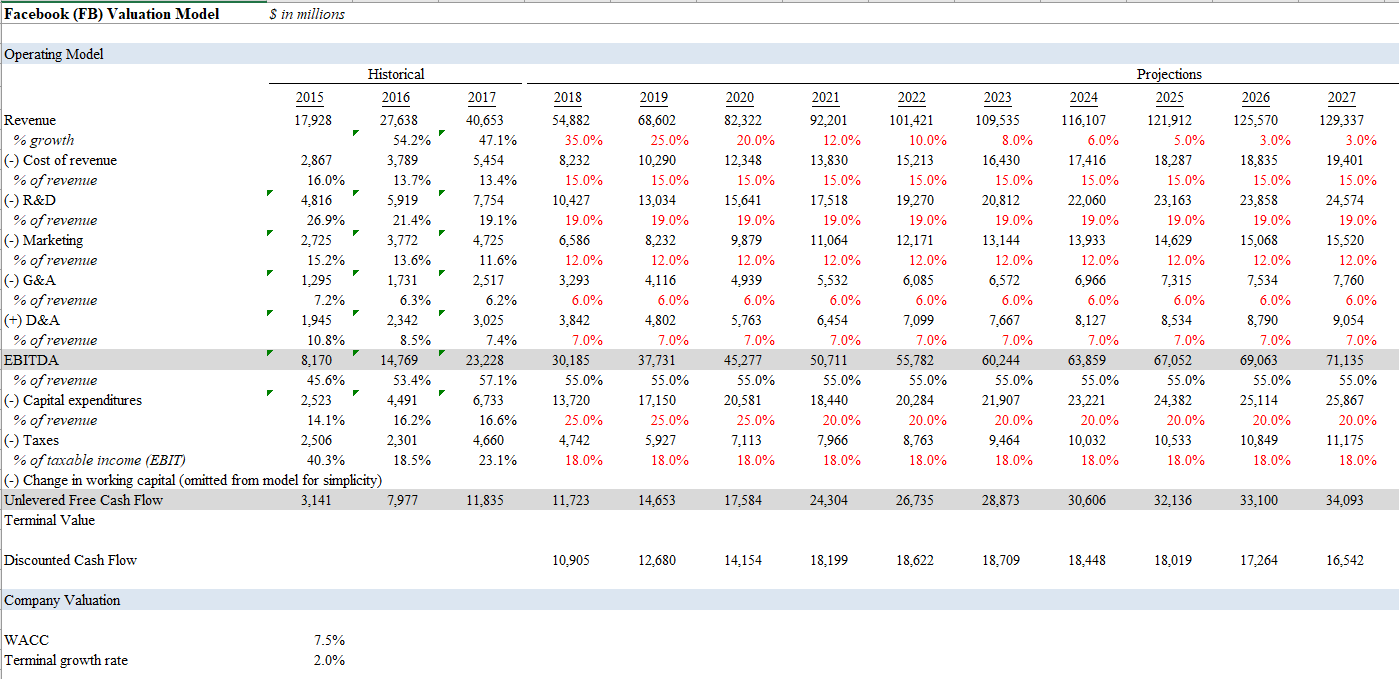

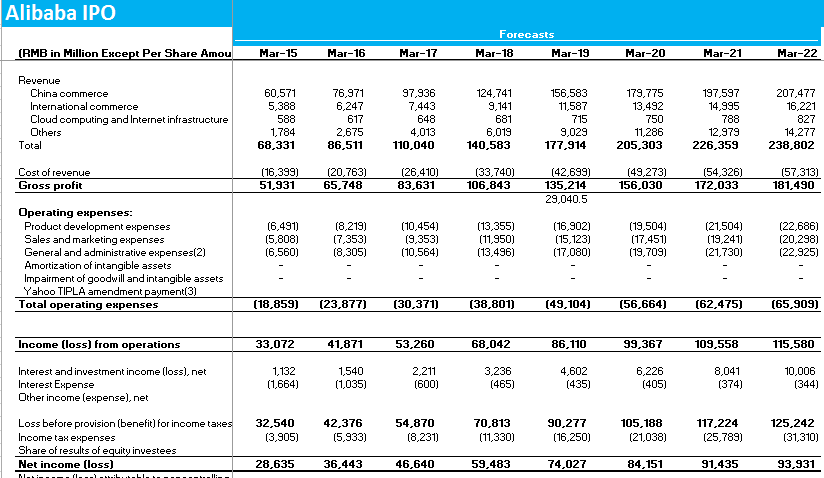

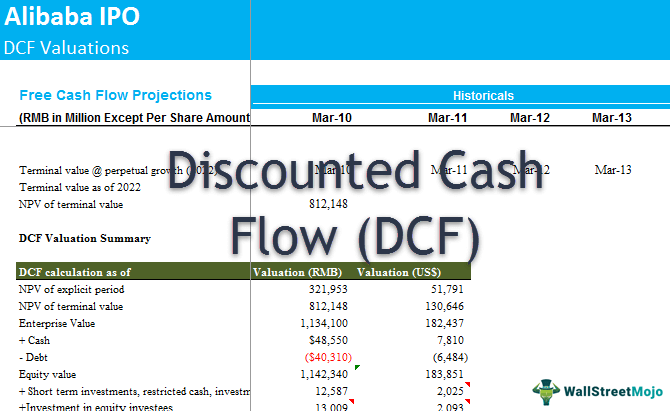

How to build a dcf model. You can download the free dcf excel template by clicking this link. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators. We walk through how to build a discounted cash flow model to calculate present value of the future cash flows of a company.

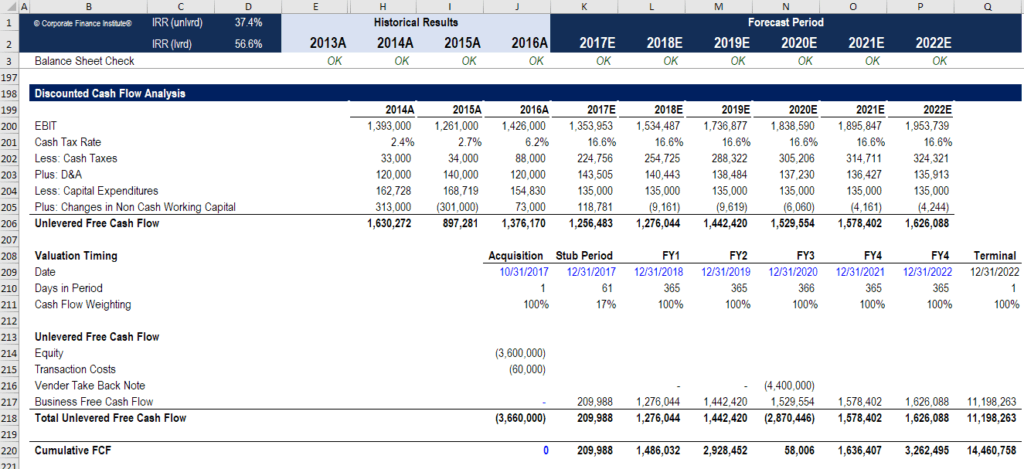

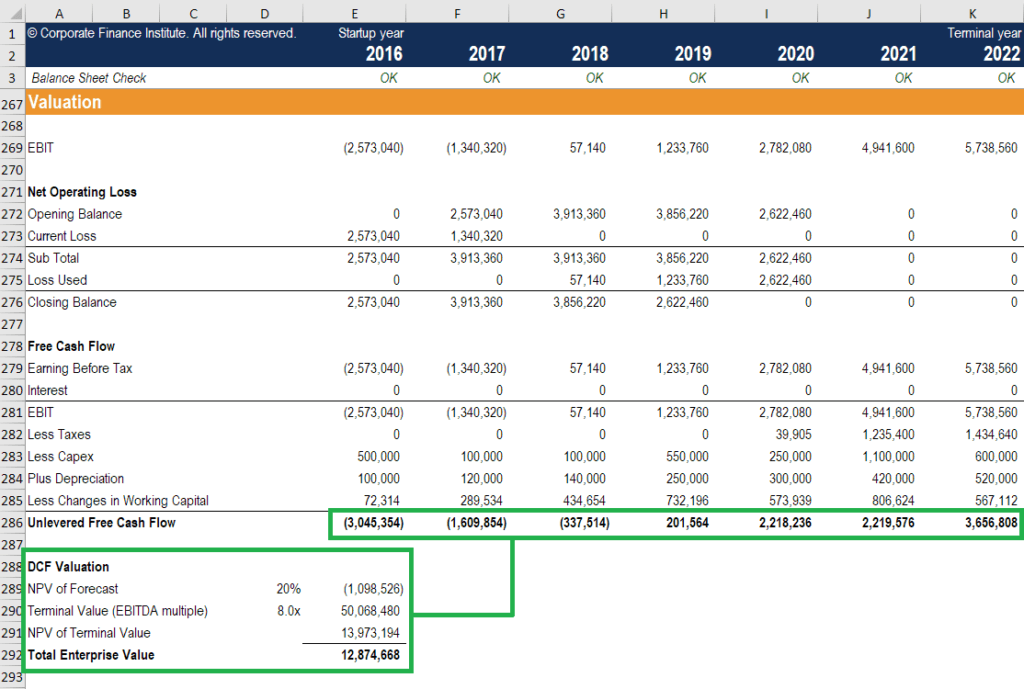

How to make dcf model in excel open google sheets on your desktop and also create a spreadsheet. Build a dcf valuation model. The second stage is the total of all cash flows after stage 1.

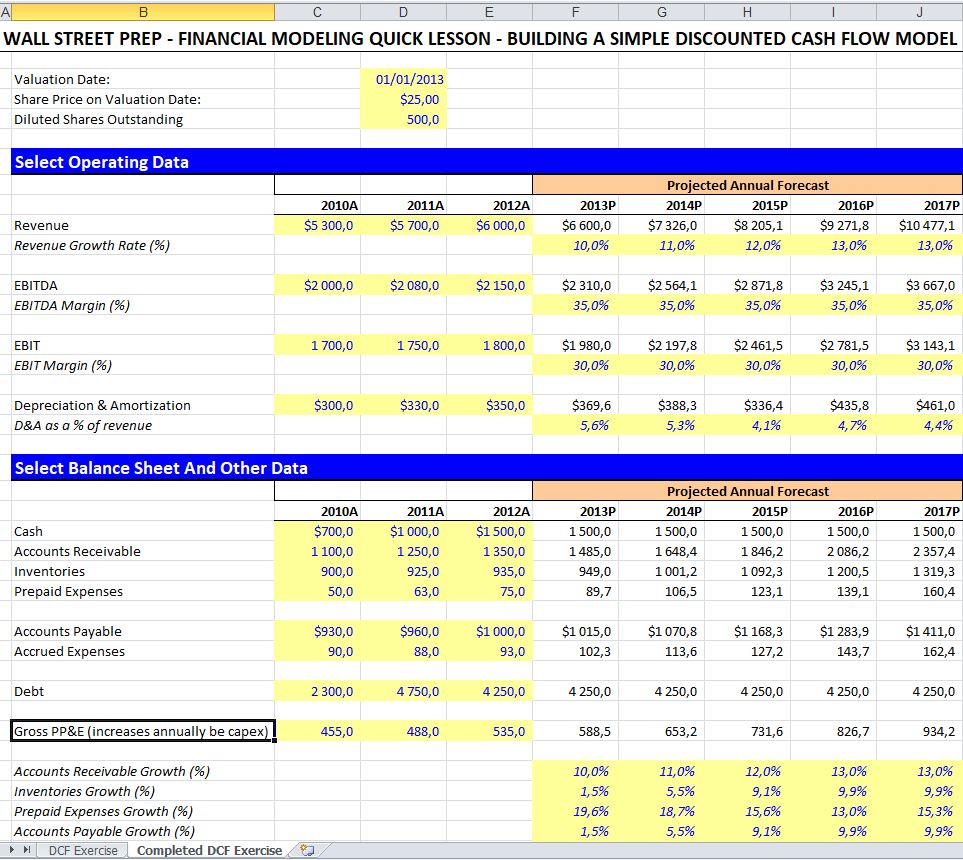

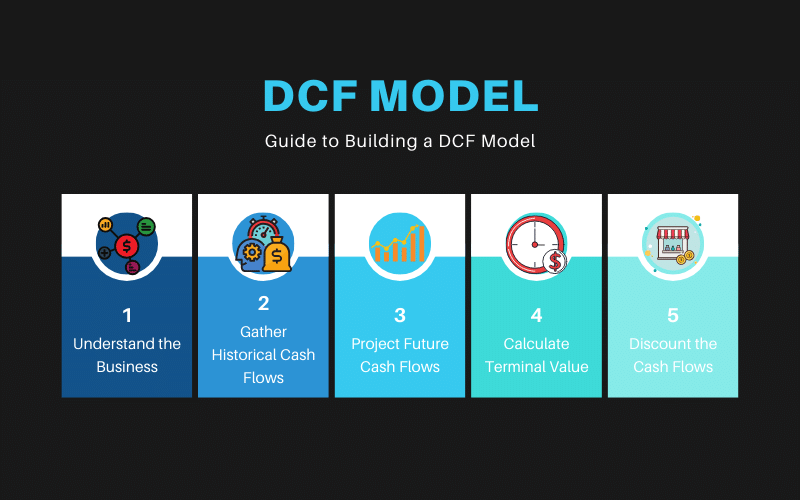

We then perform a valuation of th. Cf2 = cash flow for year two; The first step in the dcf model process is to build a forecast of the three financial statements based on assumptions about how the business will perform in the future.

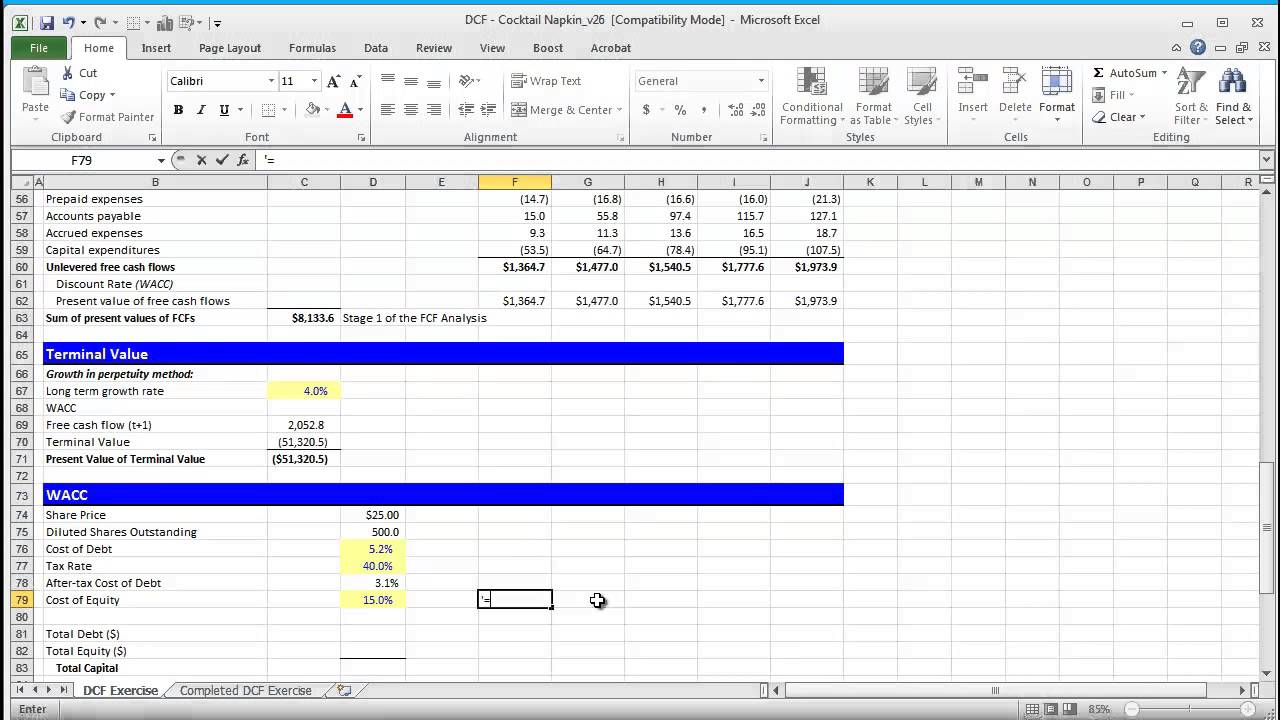

Calculate wacc on the first sheet page, using the steps above click on the [+] tab. Up to 10% cash back frequently bought together. Cfn = cash flow for additional years;

Understand the financial concepts behind a dcf model. Please click on the hd button at the bottom. This typically entails making some assumptions about the company reaching mature growth.

Includes a complete dcf model in. Up to 10% cash back build a discounted cash flow model. I typically do a discounted ca.

Next you need to determine the expected future cashflows from the valuation date onwards (since the dcf. Dcf = cf1/(1+r)¹ + cf2/(1+r)² + cfn/(1+r)ⁿ. All videos are recorded in hd.

Learn how to build a wall street quality dcf valuation model.