Best Info About How To Build Your First Budget

There are a few things you have to do only once, in order to.

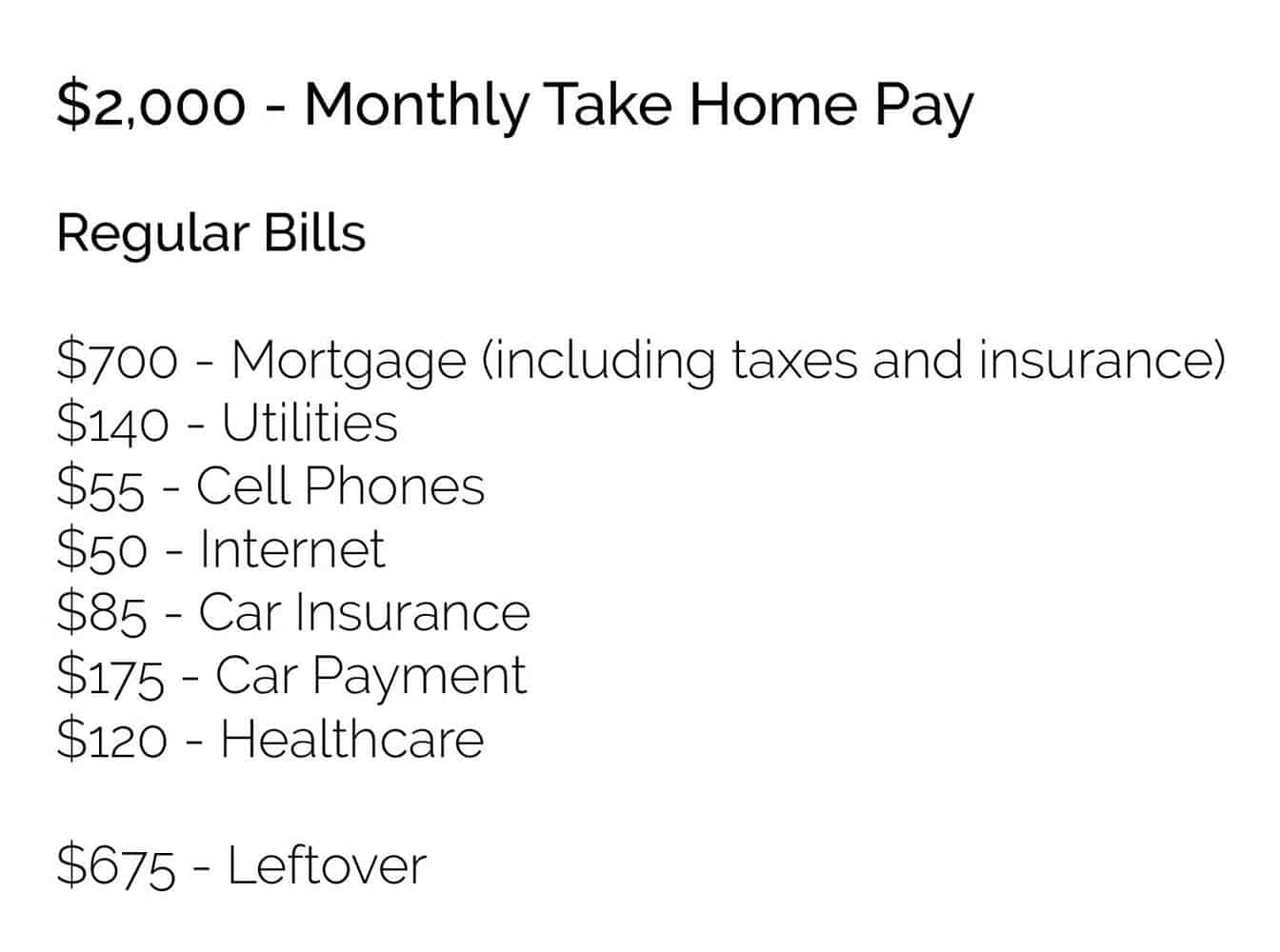

How to build your first budget. Generally, the aim is to figure out how much money you have going out of your bank account each month, and how. That way when you go to spend another $10 at target, you’ll know whether it’s in the budget or. How to build your first budget.

My favorite saying (and one i often repeat to my coaching clients) is “personal finance is personal.” it might seem like a “duh, tori” moment, but. Each transaction you record helps build a habit of awareness around your budget. Creating strong budget habits early in adult life is essential to building a pathway to financial independence.

To help you with this goal, you can refer to the last few months of bank statements or credit card. Living on your own for the first time comes with a whole new set of challenges you probably never knew existed. Torabi advocates allocating at least 10% of your income toward personal savings, which can help to cover an unexpected expense or splurge.

In this episode, chelsea walks you through everything you need to know to make your first. One popular bill percentage suggestion is the 50/30/20. A list of budgeting milestones and a list of possible rewards.

One of these adult responsibilities is budgeting. Paying $19,000 in taxes leaves you with $48,000. Here is the second episode of the college student's guide to money!

Writing out your expenses should be a lengthy process. For greater accuracy, add your earnings from the past three years and divide by 36. To calculate this, take your total monthly expenses and multiply that by 3 (or 6).

Make space to pay yourself. If you’re new to the budgeting world, you may be surprised to find out that multiple types of budgeting exist! It will take time, but once.

A little can go a long way. Add irregular or passive income, such as bonuses, commissions, dividends, rental income, and. Once you know what your spending habits actually are, the next task is to figure out what you want them to be.

Keeping a personal budget has been shown to improve financial and personal health. Set a timer for 10 minutes and brainstorm two lists: After the 10 minutes are up, assign the rewards to.

Your complete money management solution to reduce debt and maximize finances Here are some easy budgeting templates to help keep. The first part of building a budget is often much simpler than you’d think.