Favorite Tips About How To Control Debtors

Don't let it get emotional, try to avoid harsh or accusatory tones when.

How to control debtors. Of course, you can cancel one or several of your credit. No one said getting out of debt would be easy. To get out of debt you have to be ready to make tough decisions and stick to them.

Use your debt list to prioritize and rank your debts in the order you want to pay them off. Limit and for other 100000 rs., accordin. If a bad debt persists you need to make sure you deal with it legally, ethically and calmly.

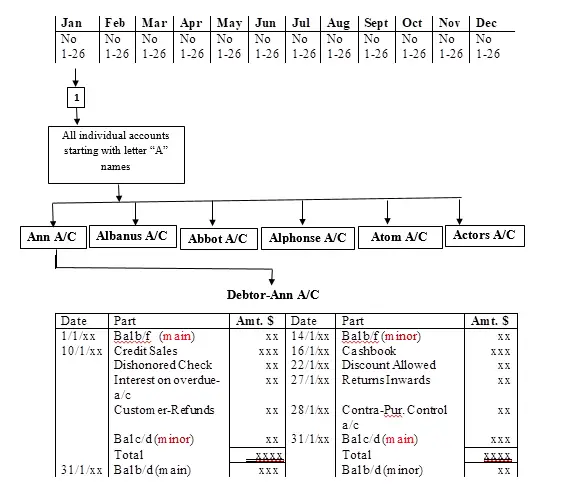

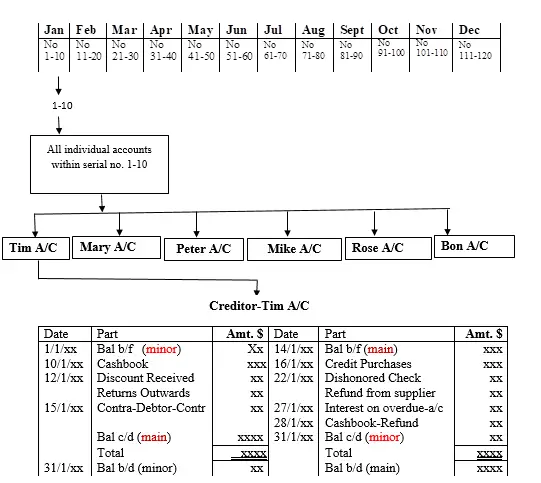

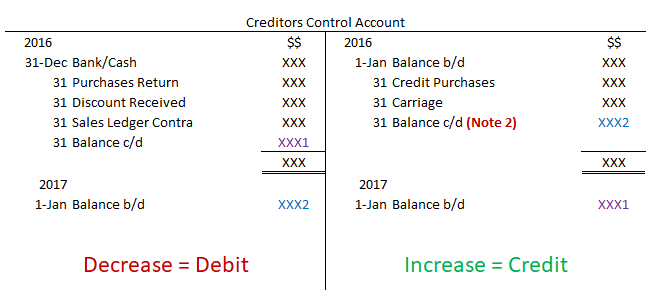

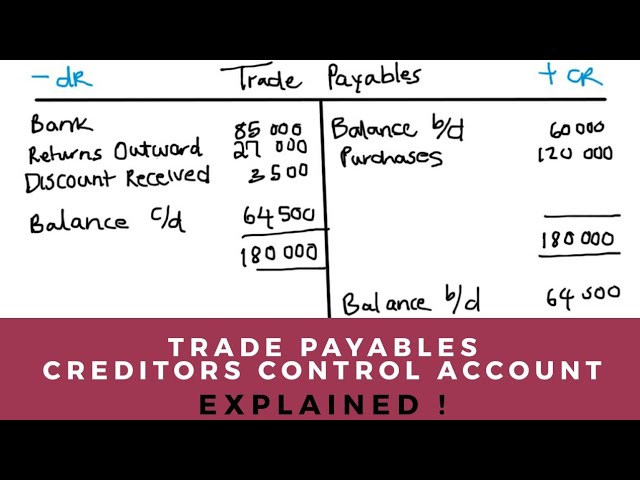

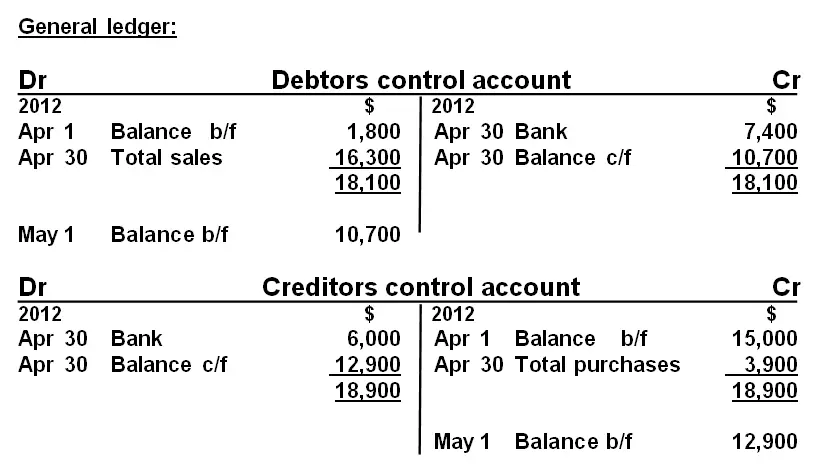

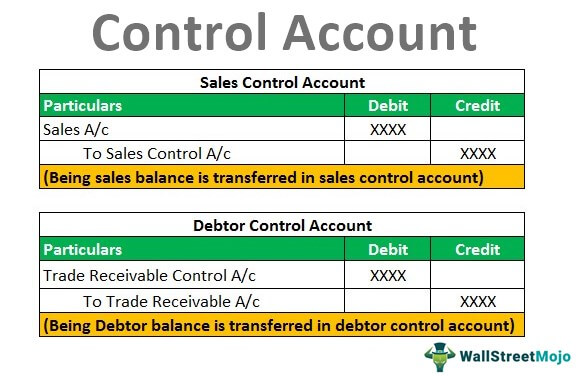

The company maintains a memorandum debtors and creditors ledger in which the individual account of customers and suppliers are maintained. Suppose, for a customer, you can fix 10000 rs. If you want to control over debtors, you should fix the credit limit.

Debtors in accounting are amounts which are owed to a business by customers, they are sometimes referred to as accounts receivable. Be crystal clear with your payment policies. If you already have debt, make a financial plan that spells out how you will pay off that debt in x amount of years.

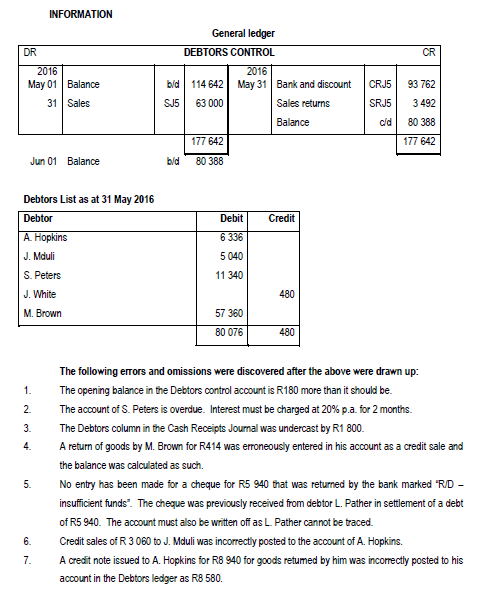

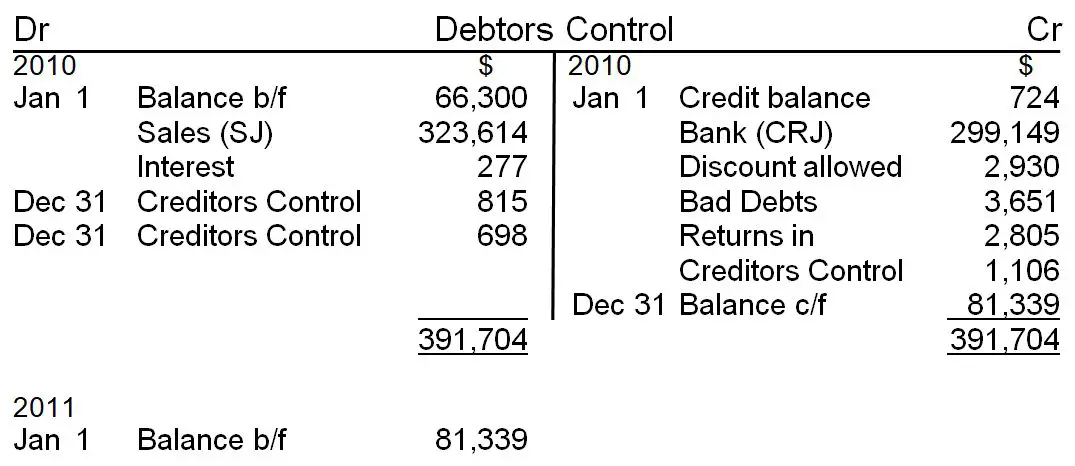

For debtors, we compare the closing balance of the debtors control account in the general ledger to the total of all the closing balances of the individual debtor accounts in the debtors ledger. Using this strategy, you’d start by paying as much as possible toward the debt with the highest. You can also choose to pay off the debt with the lowest balance first.

Send your invoices as well as reminders to your debtors immediately once a job has been completed so that both parties are aware of any money that is outstanding. In this accounting lesson, we explain what the debtors reconciliation is and why it is done. Don’t fall into the trap of assuming your clients will read the fine.

1) bad debts recovered 2) cash sales 3) cash purchases 4) increase in provision for doubtful debts these four items do not affect debtors and creditors account. Unless you stick to a repayment plan, you could quickly rack up credit card debt on top of the debt consolidation loan. In a sales control account, the total of outstanding invoices at the beginning of the period and invoices raised during the period, less payments received for invoiced income, will.

In your financial plan, there are some key things to consider.