Sensational Info About How To Lower Michigan Property Tax

Web reducing property taxes is important for your budget, especially if you live in new jersey, which is one of the states with the highest property tax rates—2.19%.

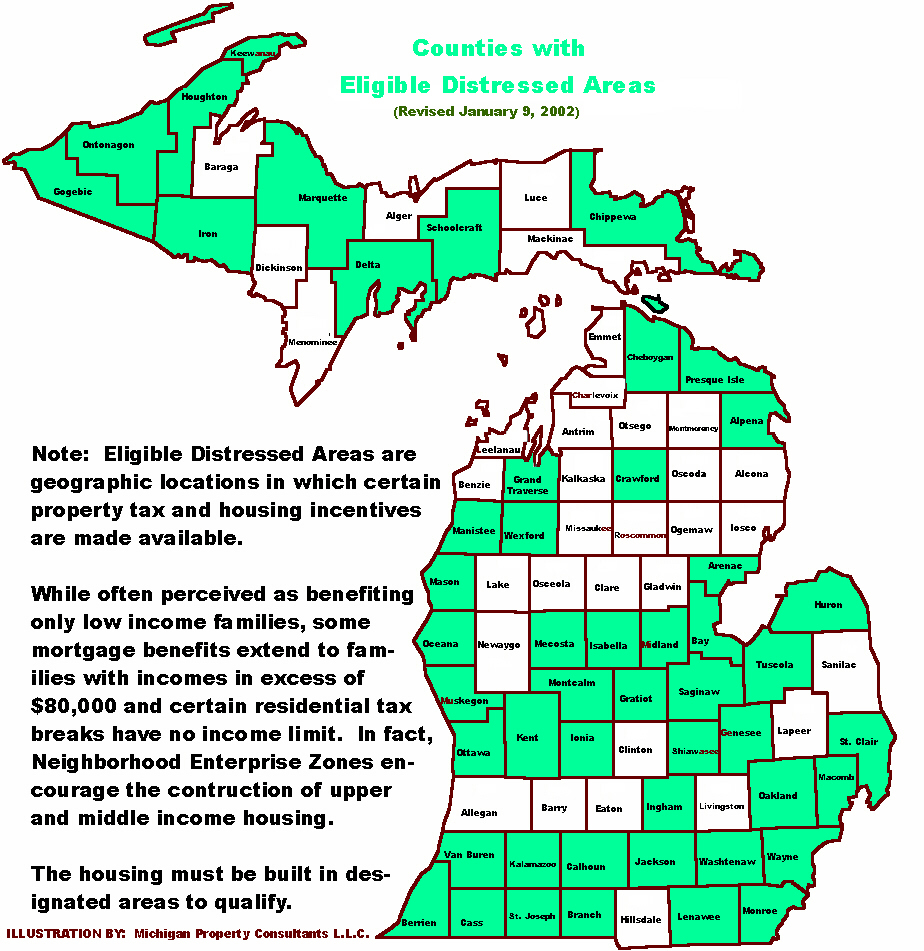

How to lower michigan property tax. Web when your taxes are too high for you to afford, you should first look to michigan's circuit breaker law for help. Web another way to reduce your taxes is to consider property tax exemptions. This is the form 1040cr filed with your state income taxes.

Cut your property taxes easily. Web michigan’s effective real property tax rate is 1.64%. Web ways to reduce a tax burden.

Web up to 25% cash back the 50% figure is also known as the assessment ratio. Those instances refer to resolutions of disputes. Web new york’s senior exemption is also pretty generous.

In fact, there are two different numbers that reflect your home’s value on your michigan real. It’s calculated at 50 percent of your home’s appraised value, meaning you’re only paying half the usual taxes. Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a charitable.

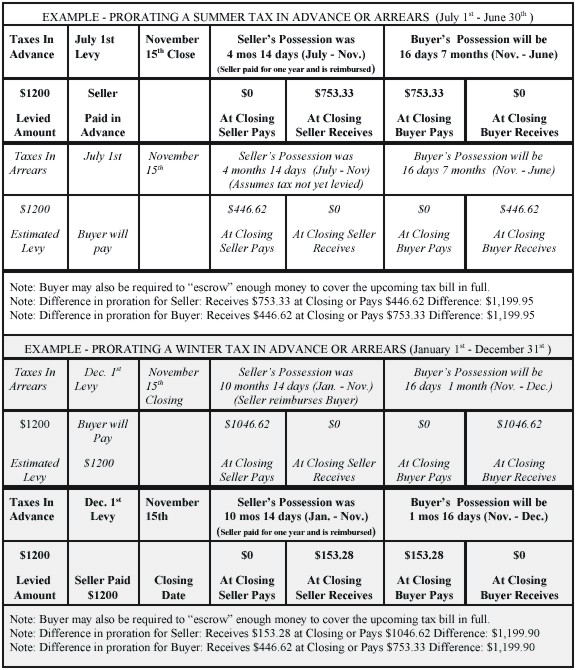

First, if indiana state taxes were withheld from your husband's. The taxing authorities multiply the taxable value of your home by the tax rate to arrive at the tax you'll. The reader may observe some instances of property tax appeal work in our client services.

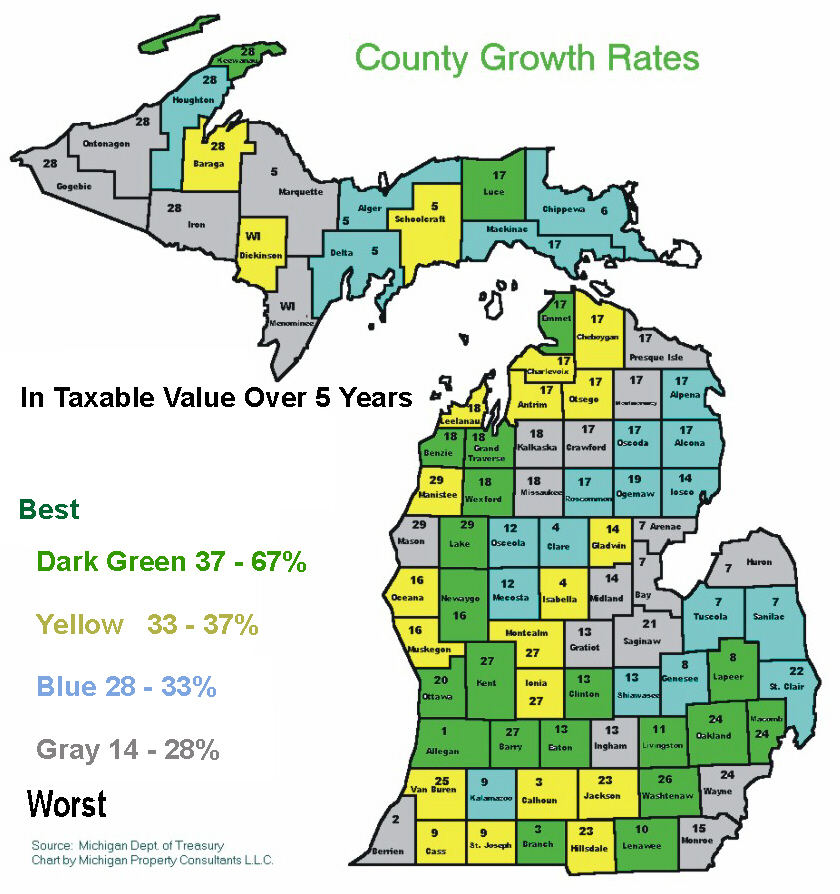

Web michigan’s wayne county, which contains the city of detroit, has not only the highest property tax rates in the state, but also some of the highest taxes of any county in the u.s. But, rates vary from county to county. Web qualifying seniors receive a tax credit worth up to 100% of their michigan property taxes that exceed 3.5% of their income, or $1,200.

Web you can reduce the michigan tax. If you belong to one of the categories entitled to them, apply for tax relief.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19631901/Screen_Shot_2020_01_27_at_10.12.12_AM.png)